YOUR RATE.

Wondering how our management fee affects your rate?

PAYG Contractors

Our fee is 2% of your gross rate, which includes Superannuation.

You may not be aware, but most recruitment agencies charge Pay As You Go (PAYG) Contractors up to 5% of their gross rate for on-hiring them, compared to Company Contractors. The reason for this is legitimate, as there are quite a few overheads such as multiple insurances, payroll, compliance and taxes… We think we can do better!

When you engage Perk Payroll, we will talk with your agency about transitioning your contract from a PAYG Contractor to a Company Contractor to get the best outcome for you. Part of our deal is that we will determine if your rate can be uplifted and split any increase with you 50/50. Other payroll providers may keep this rate uplift quiet and for themselves.

The best part is that you can switch to Perk Payroll at any time!

You don’t need to wait until the end of your contract to start working with us.

For example:

If your gross rate is $90 per hour and we cannot uplift your rate, our fee is $1.80 per hour and your new gross rate is re-calculated to $88.20 per hour.

If your gross rate is $90 per hour and we were able to negotiate a rate uplift to $93.75 per hour, our fee is $3.72 ($1.88 + $1.84) per hour and your new gross rate is re-calculated to $90.03 per hour.

| Your Rate per Hour |

Recruitment Agency | Perk Payroll without Uplift |

Perk Payroll with Uplift |

|---|---|---|---|

| Gross Rate | $90.00 | $90.00 | $93.75 |

| Rate Uplift Split | $0.00 | $0.00 | $1.88 |

| Uplifted Gross Rate | $90.00 | $90.00 | $91.87 |

| Perk Payroll Fee | $0.00 | $1.80 | $1.84 |

| Recalculated Gross Rate | $90.00 | $88.20 | $90.03 |

| Taxable Income | $82.20 | $80.55 | $82.23 |

| Superannuation | $7.80 | $7.65 | $7.80 |

Company Contractors

Our fee is 2% of your gross rate, which excludes GST.

Company Contractors can benefit greatly from using Perk Payroll, with savings, client diversity, wages and tax advantages to be gained. Company Contractors include Sole Traders, Partnerships, Businesses, Companies and Trusts which are typically registered for GST. Depending upon your circumstances, we think you will be pleasantly surprised!

When you engage Perk Payroll, we will talk with your agency about transitioning your contract to us, to get the best outcome for you. Part of our deal is that we cover you with our Professional Indemnity, Public Liability and WorkCover insurances and while unlikely, we will determine if your rate can be uplifted.

The best part is that you can switch to Perk Payroll at any time!

You don’t need to wait until the end of your contract to start working with us.

For example:

If your gross rate is $93.75 per hour, our fee is $1.87 per hour and your new gross rate is re-calculated to $91.88 per hour.

As it is unlikely for us to uplift your rate any higher than your current company contractor rate, we have removed these calculations from the table below.

| Your Rate per Hour (Ex GST) | Recruitment Agency | Perk Payroll without Uplift |

|---|---|---|

| Gross Rate | $93.75 | $93.75 |

| Rate Uplift Split | $0.00 | $0.00 |

| Uplifted Gross Rate | $93.75 | $93.75 |

| Perk Payroll Fee | $0.00 | $1.87 |

| Recalculated Gross Rate | $93.75 | $91.88 |

| Insurances | $1.40 | $0.00 |

| Taxable Income | $92.35 | $91.88 |

DARE TO COMPARE.

With Perk Payroll, you will pay less tax and have more money in your pocket!

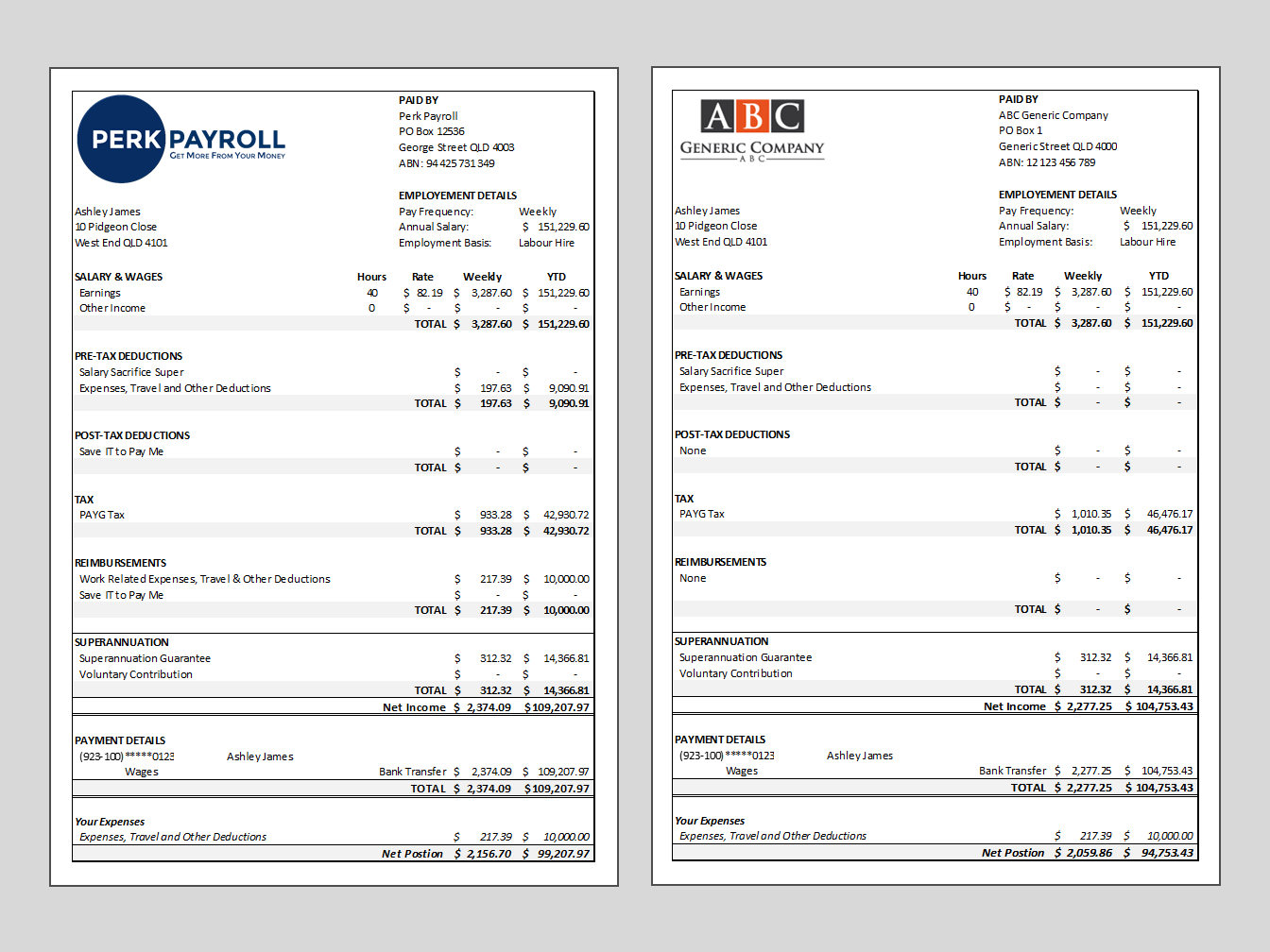

Still wondering how effective Perk Payroll really is?

Let’s take a client who earns $90 per hour (including Superannuation) and they spend $10,000 on work related items, work related expenses, travel, superannuation contributions and allowances over the year.

Perk Payroll applies the $10,000 deduction against their pre-tax income, which significantly lowers their taxes and adds it back to their pay as non-taxable earnings.

This provides immediate savings of $4,454 over the year or a 44.5% discount on their expenses!

How’s that for getting more from your money!

An extra $4,454 paid into their bank account with their pay.

Download our comparison pay slips and case study for free!